Background

With finances becoming increasingly under pressure, business needs to identify ways in which the same income can be stretched further. Luckily, the South African tax system allows this, while potentially benefiting staff.

The background to this is that any bona fide scholarship or bursary granted to enable or assist a person to study at a recognised institution is exempt from normal tax.

The Revenue Amendment Bill of 2017 increased the remuneration threshold of employees for whom this benefit can be made available, as well as increasing the amounts that are payable (applicable to the 2018 tax year).

Taking advantage of this now allows companies to help a relative of an employee if the following criteria are met:

- The employee’s remuneration is up to R 600 000 per annum, i.e. up to R 50 000 per month, or less, and

- The employee has children or family members studying between grades R and 12, or NQF levels 1 through 10, and

- The employee is contracted to repay the bursary in the event of the bursary recipient not completing their studies (other than for reason of death, ill-health or injury).

If an employee fits the above criteria, the employer can pay them between R 20 000 and R 60 000 per year, per learner, tax free! And, should the person be disabled, the values are even greater.

The rules

For learners from grade R to grade 12 (i.e. pre-school to matric), bursaries of up to R 20 000 per learner per year may be given.

For learners studying for NQF levels 1 to 10 qualifications, bursaries of up to R 60 000 per learner per year may be given.

The value given may cover some or all of the following:

- Fees (tuition, registration and / or examination)

- Books

- Equipment

- Accommodation, meals and transport

The fees are paid in advance to the institution directly. There is no re-imbursement to the employee on successful completion of studies.

Things to watch out for

- The institution needs to be a recognised educational or research institution, registered within South African law, or, if a foreign institute, it must be formally recognised by the South African Qualifications Authority (SAQA, www.saqa.org.za );

- If the employee earns commission or a bonus which would take them over the R 600 000 per annum, this scheme is not applicable;

- Should any of the above criteria not be met, the bursary becomes taxable as a fringe benefit, and the employee is liable for the tax payable.

Taxable bursaries / study loans

Should a bursary not comply with the above, it becomes taxable as a fringe benefit. The following should be recorded on payroll and added as taxable income, as they cannot be considered bursaries:

- Low interest / no interest loans to assist a staff member to pay for their studies;

- If the staff member is not required to pay back monies given to pay for their studies;

- Awarding an employee an additional amount (once off or added to salary) for having completed their studies.

In the event that the value of a legitimate bursary exceeds the limits of R 20 000 or R 60 000 per annum, the additional value should be taxed as a fringe benefit. Additionally, if you have an agreement that, if the studies are not completed, the bursary reverts to a loan to the employee, the loan becomes taxable as a fringe benefit at the time that the bursary becomes a loan, due to non-compliance.

So how do we make use of this tax exemption?

There are not many companies who can suddenly start adding up to R 60 000 cost per employees’ child who is studying. So how do we go about making use of this provision practically?

We suggest that this is done very methodically.

- Determine how many employees you have who fulfil the criteria of earning less than R 600 000 in a year (remember, this is deemed remuneration / remuneration proxy, and is likely to span more than one tax year, so you will need to determine the estimated value for the employee over the period – it would be preferable to be conservative);

- Determine how many of these employees have children / family members who are / would like to be studying;

- Set up policies which stipulate how the business is going to decide who they can help. Will it be connected to years of service with the company, perhaps?

- Consider having the conversation with these qualifying employees, long before the next salary increase cycle, so that you can offer them the bursary as a component of a normal increase in salary.

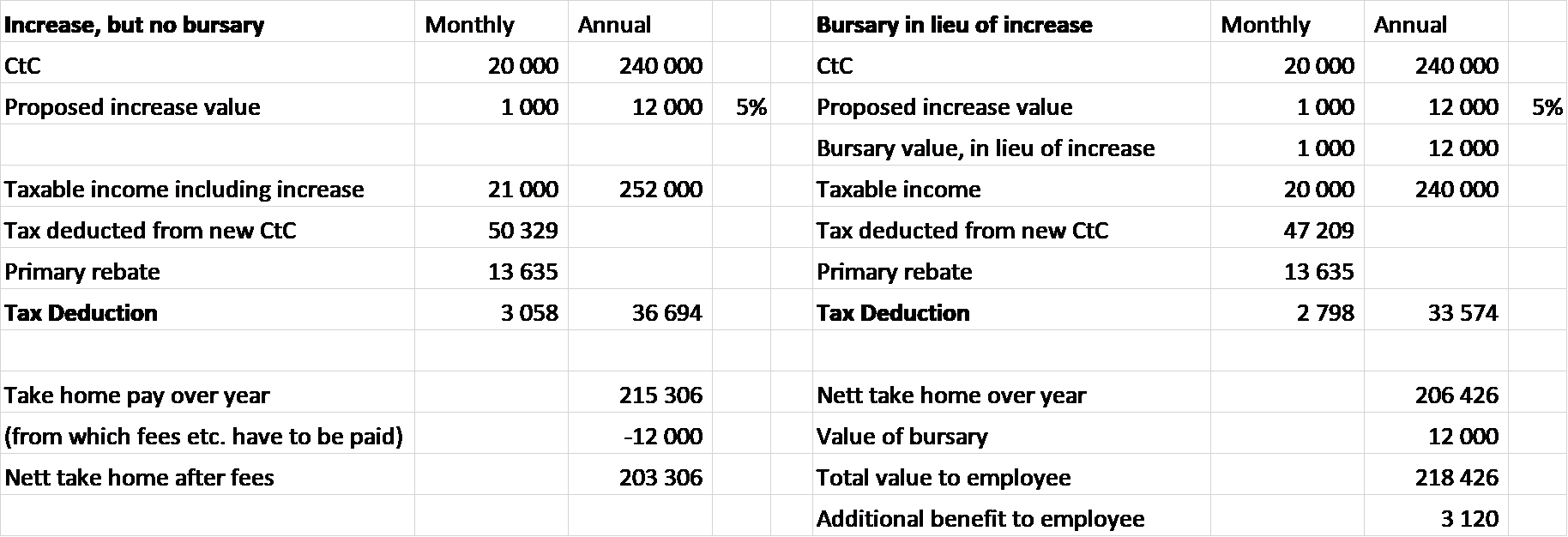

In the following example, an employee earning R 20 000 per month is about to earn a 5% increase, i.e. an additional R 1000 per month. According to the company policies, the employee opts to take the full increase as a bursary for their child’s schooling. Following this principle, the employee effectively benefits from a tax perspective by R 3 120 in a year.

Reporting on the tax exemption

The bursary should be included in the payroll reporting of the organisation. The following SARS codes should be linked to the payroll elements in use:

3815

Bursaries or Scholarships – Non-Taxable

3809

Bursaries or Scholarships – Taxable

3820

Bursaries or Scholarships (Further Education) – Taxable

3821

Bursaries or Scholarships (Further Education) – Non-Taxable

The taxable codes are to be used in the event that the bursary exceeds the R 20 000 or R 60 000 per year allowed (dependent on the level of qualification – see above). All these values will be included in the employee’s tax certificate at the end of the tax year.

Conclusion

To ensure that your company runs an effective bursary scheme, a fair amount of work is required to ensure that the policies and rules for managing the scheme are clearly defined, and included in policy documents. Employment agreements are also necessary, and should be formal, detailing that the employee has chosen a bursary in lieu of an increase to salary, and the implications (if any) of failure of the learner.

Should the bursary/scholarship be in addition to an increase, it is necessary to build a policy around the processes at the conclusion of the study period.

Once these have been put in place, however, this is a wonderful advantage to employer and employee, and an opportunity to assist in something critically important to South Africa – investment in our future generations.

Accsys provides people management solutions i.e. Payroll, Human Resources (HR), Time and Attendance as well as Access Control/Visitor Management.

The company develops, implements, trains and services our solutions, as well as delivering and installing readers, turnstiles, booms and CCTV.

We run both on premise and in the cloud, as well as mobile options for ESS. Recruitment, online education and Business Process Outsourcing (BPO) are part of our offering, too.

References:

Interpretation note 66

Tax Administration Act - Section 10(1)(q)(ii)(aa) and (bb), Paragraph 2(h) of the Seventh Schedule

Guide for Employers in Respect of Employees Tax (2018 Tax Year) – PAYE-GEN-01-G11